Equities Market Research

Trending

Market Metrics That Matter: Your Monthly U.S. Cash Equities Volume Briefing

Cboe BYX® Equities Exchange (BYX) Periodic Auctions had over 1,562 unique stocks entered this month. Learn more about Periodic Auctions here. September notional traded value was $81.1 million with 1,231 distinct stocks trading.

Read MoreSeptember Highlights

- Chris Isaacson, Executive Vice President, Chief Operating Officer, participated in the SEC Regulation NMS roundtable advocating for retaining Rule 611 but with targeted modifications. Cboe believes that Rule 611 of Regulation NMS is worthy of review. As always, though, Cboe notes that changes to any one rule can have cascading impacts on other requirements and on the incentives that ultimately shape the marketplace. In this regard, it is important that we consider these implications when considering any significant change to Rule 611. Read Cboe’s letter to the SEC here.

- Cboe BYX® Equities Exchange (BYX) Periodic Auctions had over 1,562 unique stocks entered this month. Learn more about Periodic Auctions here.

- September notional traded value was $81.1 million with 1,231 distinct stocks trading.

- Cboe announced support for transaction fees for U.S. equities as part of the ongoing process of adapting to new SEC rules. Learn more.

Upcoming Changes

November 7, 2025 | Cboe BZX® Equities Exchange (BZX) will update Limit-On-Close (LOC) and Late-Limit-on-Close (LLOC) order behavior to improve Closing Auction stability and enhance price discovery.

News and Insights

- How Cboe is Supporting the Growing ETF Market

- Cboe Plans to Launch Cash-Settled Futures and Options on New Index Tracking Tech and Growth-Orientated U.S. Stocks

- Cboe Plans to Launch Continuous Futures for Bitcoin and Ether, Beginning November 10

U.S. Listings

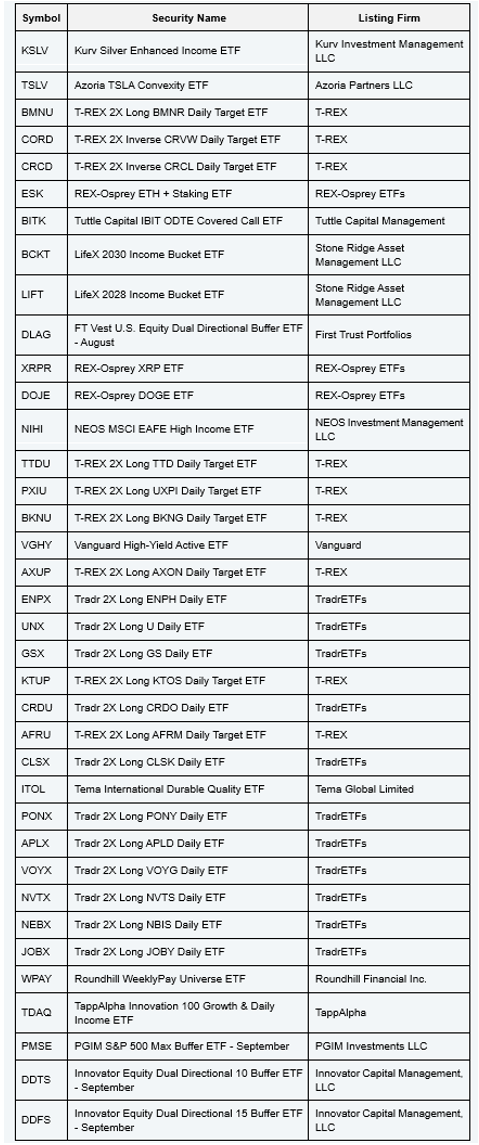

In September, 37 new Exchange Traded Funds (ETFs) were listed on BZX.

-

Read MoreHow Cboe is Supporting the Growing ETF Market

-

Read MoreMarket Metrics That Matter: Your Monthly Canadian Cash Equities Volume Briefing

-

Read MoreCboe’s Pan-European Solution for Enhancing Retail Executions

-

Read MoreMarket Metrics That Matter: Your Monthly U.S. Cash Equities Volume Briefing

-

Read MoreCanadian Cash Equities July Highlights

-

Read MoreHow Outcome Based ETFs Are Reshaping Investor Demand

-

Read MoreU.S. Cash Equities July Highlights

-

Read MoreExpanding Retail Access in Europe through a Pan-European EBBO

-

Read MoreCapturing Liquidity with Cboe's Periodic Auctions

-

Read MoreCanadian Cash Equities June Highlights

-

Read MoreU.S. Cash Equities June Highlights

-

Read MoreCanadian Cash Equities May Highlights

-

Read MoreThe Titanium Effect: Reengineering Cboe Canada's Trading Infrastructure

-

Read MoreU.S. Cash Equities May Highlights

-

Read MoreU.S. Cash Equities April Highlights

-

Read MoreFollow the Flow: Maximizing Executions with Cboe Routing Strategies

-

Read MoreFind Your Edge with Cboe's OCS

-

Read MoreEarly Birds and Night Owls: How Extended Trading Hours are Reshaping U.S. Equities Markets

-

Read MoreFlipped & Flowing: Liquidity Growth on EDGA’s Maker-Taker Conversion

-

Read MoreWhat Does it Take to Offer Around the Clock Equities Trading?

-

Read MoreNorth American Equities Year in Review

-

Read MoreNorth American Equities Year End Update

-

Read MoreU.S. Equities Volume Drivers: Retail Trading in Subdollar Securities

-

Read MoreGrowth of U.S. Equities Volumes and Rise of Retail

-

Read MoreTrading the U.S. Globally

-

Read MoreConnecting Blocks with Cboe BIDS Canada

-

Read MoreRetail Price Improvement Provides Unique Opportunities for Retail Investors and Liquidity Providers

-

Read MoreThe Growth of Canadian Depositary Receipts

-

Read MoreCanadian Equities Exchanges Today

-

Read MoreThe Unintended Consequence of Market Structure Reform: Cutting Out the Everyday Investor

-

Read MoreHow Periodic Auctions Enhance Trading in Europe and the U.S.

-

Read MoreU.S. Equities Trading Venues: A Closer Look

-

Read MoreThe Power of Price Improvement

-

Read MoreOff-Exchange Trends: Beyond Sub-dollar Trading

-

Read MoreMore Investors Turn to Inverted Exchanges in Canada

-

Read MoreCboe's Perspective on Proposed Updates to Regulation NMS

-

Read MoreHow Subdollar Securities are Trading Now

-

Read MoreAn Update to our Tick Reform Proposal

-

Read MoreHow Cboe North American Equities Evolved with the Changing Landscape in 2022

-

Read MoreHide-and-Seek: Hidden Liquidity on U.S. Exchanges

-

Read MoreCboe MATCHNow’s Willing To Trade Enhances Investors Ability to Source Block-Sized Liquidity

-

Read MoreWhat Sets NEO-L Apart

-

Read MoreEnhanced Execution with Retail Priority

-

Read MoreCboe Proposes Tick-Reduction Framework to Ensure Market Structure Benefits All Investors

-

Read MoreThe Evolution of Retail Investment Activity

-

Read MoreHow Increased Quote Depletion Protection Usage Benefits Investors

-

Read MoreThe Value of Inverted Exchanges

-

Read MoreHow Retail Priority Benefits End Investors

-

Read MoreContinued Growth in Cboe BIDS Canada Conditionals

-

Read MoreStock Splits Lead to Split Results in Trading

-

Read MoreThe Latest on Changing Market Dynamics

-

Read MoreMeeting Global and Retail Participant Needs Through Market Evolution

-

Read MoreChanges and Opportunities in Canadian Dark Trading

-

Read MoreCboe Completes MATCHNow Technology Migration

-

Read MoreNorth American Equities Yearly Recap and Look Ahead

-

Read MoreHow Meme Stocks Impact Options Trading

-

Read MoreAn In-Depth View Into Odd Lots

-

Read MoreInterlisted Trading Trends and Opportunities

-

Read MoreThe Lasting Results of an Unprecedented Market Environment

-

Read MoreCboe Advocates for Targeted Equity Market Structure Reform

-

Read MoreThe QDP Difference

-

Read MoreA Deep Dive Into U.S. Equities Trading Venues

-

Read MoreMATCHNow Conditionals Update

-

Read MoreSmart Execution with Quote Depletion Protection

-

Read MoreWhat's Next for MATCHNow

-

Read MoreDon’t Let your Clients Fall Behind with Delayed Data

-

Read MoreCboe EDGX Introduces Early Trading Session

-

Read MoreThe Year Ahead for North American Equities

-

Read MoreThe Price is Right! A Closer Look at Sub-Dollar NMS Stocks

-

Read MoreThe Impact Closing Auctions Have on Volumes

-

Read MoreAn In-Depth View Into U.S. Equity Markets

-

Read MoreMATCHNow Conditionals: How to Achieve Block Size Executions

-

Read MoreLighting up the Dark: Hidden Trends In Off-Exchange Trading

-

Read MoreManage Your U.S. Equities Risk on Your Own Terms

-

Read MoreIntroducing Cboe Quote Depletion Protection

-

Read MoreHow to Enhance Order Execution During High Volatility

-

Read MoreA Message From Cboe Europe President David Howson

-

Read MoreCboe Equities Update: April 16, 2020

-

Read MoreFour Key Ways to Improve Equity Market Structure

-

Read MoreWhat to Know About Cboe Market Close

-

Read MoreU.S. Equities Initiatives in 2020: A Note to Customers