Cboe U.S. Treasuries

Bringing Large Size, Low Impact Trading to the On-the-Run U.S. Rates Market

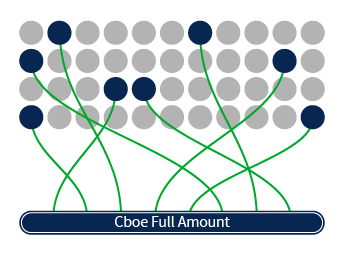

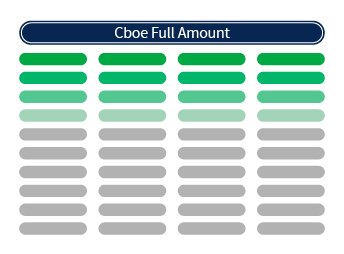

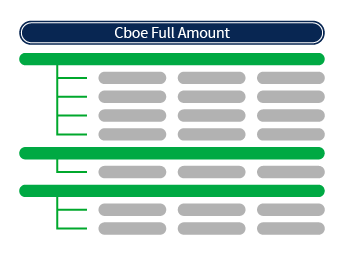

Cboe's Full Amount technology consolidates streaming quotes from the market's premier dealers into a single best price at each desired size level, resulting in an efficient tool to access and manage liquidity. Liquidity consumers transact against the best quote from a single liquidity provider that satisfies the full amount of the order to ensure minimal information leakage and reduced slippage.

As a Liquidity Provider

Leverage Cboe's technology to anonymously distribute pricing with the assurance of being the full size of the incoming order.

As a Liquidity Consumer

Transfer risk in size with efficiency and low market impact, while potentially earning price improvement on each trade.

Access & Reporting

Clients, who must be FICC members, may access Cboe U.S. Treasuries using FIX order entry or the market's leading vendors. Real-time market data is available via ITCH.

Liquidity is customized to enhance execution quality, driven by Cboe's liquidity management and analytics suite.

How Cboe U.S. Treasuries Works

Engagement

Cboe actively engages with Participants to construct and refine Full Amount liquidity pools based on quantitative and qualitative measures.

Liquidity

Liquidity consumers receive streaming top-of-book quotes across the on-the-run curve, in various sizes.

Streaming

Configured liquidity providers continuously quote in prescribed sizes, filling aggressing Immediate-or-Cancel orders in a single-ticket.

Low Impact

Top of book prices are disseminated for each security and size via ITCH market data. Orders will never 'sweep' the market.

Cboe Fixed Income Markets, LLC ("Cboe Fixed Income") is a registered broker-dealer with the U.S. Securities and Exchange Commission, and is a member of the Financial Industry Regulatory Authority, Inc. (www.finra.org). Cboe Fixed Income does not provide services to retail customers.