Volatility Insights

Trending

Cboe® iBoxx® Credit Futures Unpacked - Examining the Key Drivers Behind Their Record Market Adoption

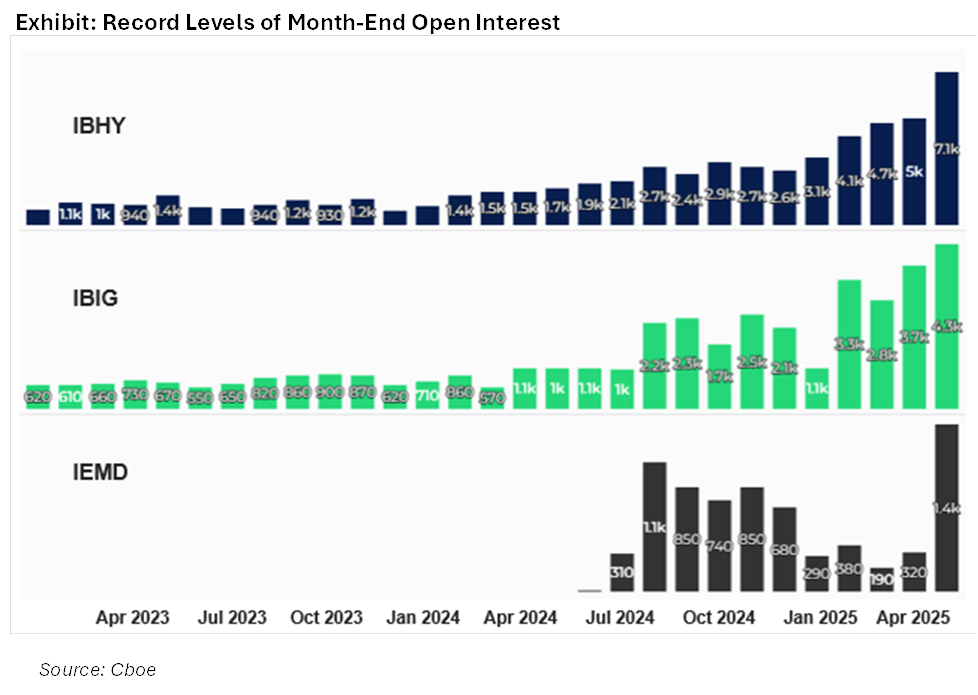

The corporate bond market is undergoing a profound transformation, driven by electronification and a demand for more efficient, standardized instruments. Reflecting this evolution, Cboe® iBoxx® Credit Futures have recently experienced unprecedented growth in market adoption. Open interest in IBHY futures has skyrocketed by 4.5 times year-over-year to $1.2 billion, while IBIG futures have seen a 4.4-fold increase to nearly $600 million.

Read MoreExecutive Summary:

- The corporate bond market is undergoing a profound transformation, driven by electronification and a demand for more efficient, standardized instruments. Reflecting this evolution, Cboe® iBoxx® Credit Futures have recently experienced unprecedented growth in market adoption. Open interest in IBHY futures has skyrocketed by 4.5 times year-over-year to $1.2 billion, while IBIG futures have seen a 4.4-fold increase to nearly $600 million.

- This remarkable growth is propelled by end-user demand, with a diverse and expanding base of customers leading the charge. This demonstrates a fundamental shift as traditional asset managers, hedge funds, pension funds, and insurance companies actively integrate these futures into their core investment and risk-management strategies - employing them for capital-efficient beta exposure, hedging, asset allocation, arbitrage, RV/tactical trading, and more. Such diversity furthers two-sided liquidity and market resilience across different market regimes.

- The recent "Liberation Day" tariff announcements by President Trump have triggered significant market volatility and a surge in credit futures trading volume as investors turned to credit futures as effective instruments for hedging and speculation. Cboe's credit futures combine both credit and interest rate risk - the optimal hedging strategy, including whether to take offsetting UST futures positions, is highly contingent upon prevailing macroeconomic environment and the nature of the market shock (deflationary vs. inflationary).

- This report analyzes the expansion of these futures, identifies the key drivers behind their adoption, and highlights their strategic applications for a diverse range of market participants. In an increasingly complex macroeconomic landscape, credit futures have emerged as an indispensable tool for achieving cost-effective beta exposure, hedging risks, and optimizing capital allocation. For more, please see full report here.