Derivatives Market Research

Trending

Henry Schwartz's Zero-Day SPX® Iron Condor Strategy: A Deep Dive

Henry Schwartz, Vice President, Market Intelligence, recently explored the growth of 0DTE in a technical and data-driven session at HOOD Summit ‘25. Diving into how the market has evolved, Schwartz shared insights that reveal the institutional-level thinking behind what has become retail trading's newest frontier.

Read MoreShort-dated options trading and zero-days to expiry (0DTE) contracts are increasingly important to investors’ portfolios. As retail traders become more comfortable integrating 0DTE contracts into their broader strategies, there is a growing need for deeper understanding of new strategies.

Henry Schwartz, Vice President, Market Intelligence, recently explored the growth of 0DTE in a technical and data-driven session at HOOD Summit ‘25. Diving into how the market has evolved, Schwartz shared insights that reveal the institutional-level thinking behind what has become retail trading's newest frontier.

The 0DTE Market Revolution

Noteworthy Market Statistics*

- 62% of S&P 500 Index options volume is comprised of 0DTE contracts

- 50% of this 0DTE activity comes from retail traders

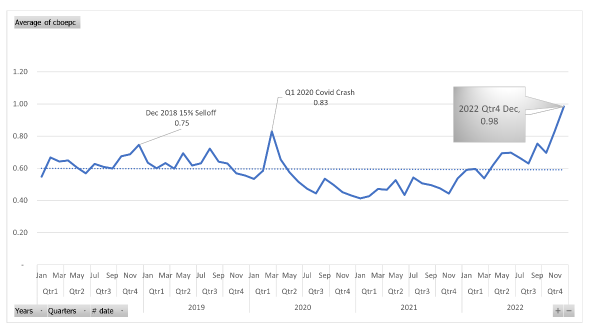

- This volume represents a fundamental shift in how traders participate in options markets and highlights new opportunities for greater precision. As Schwartz emphasized in his session, 0DTE wasn't even a significant market segment just a few years ago.

The SPX Iron Condor Strategy Breakdown

Core Philosophy: Binary Thinking Over Volatility Models

Schwartz's approach to 0DTE trading differs from how he implements longer-dated options strategies:

"When you're talking about 0DTE options, it's much more binary. It's basically a line in the sand."

In other words, you're expressing a very short-term view on where the market will close in a few hours, in contrast to longer-term directional or volatility-based strategies.

Specific Trade Construction

The Setup (as executed):

- Underlying asset: S&P 500 Index (SPX) at 5,636

- Put Spread: Sold 6520 Put / Bought 6510 Put

- Call Spread: Sold 6550 Call / Bought 6560 Call

- Premium Collected: Approximately $1.00 per spread ($2.00 total)

- Net Credit Received: $1.90 (after execution)

Target Parameters

The "Dollar Rule": For mid-day trades, this strategy looks for 10-point spreads that yield approximately $1.00 in premium each:

- Risk-Reward Ratio: 9:1 on each individual spread

- Combined Logic: Since SPX can't close both above the call strikes AND below the put strikes simultaneously, two separate 9:1 risk:reward trades are essentially made but only one can lose

Margin Efficiency Insights

Schwartz highlighted a crucial advantage of spread trading in SPX:

- Naked SPX Option Margin: $650,000 for a single contract (due to SPX being a $6,500+ index)

- Spread Margin: Dramatically reduced to the width of the spread

- Accessibility: This margin efficiency can make SPX trading viable for retail accounts

Entry Timing and Market Conditions

Optimal Entry Scenarios

Henry identified specific market conditions that have typically favor iron condor strategies:

Preferred Conditions:

- After intraday volatility spikes, not during consolidation periods

- Post-morning economic data releases, for example CPI report at 8:30 AM

- Following significant directional moves that then begin to consolidate

Unfavorable Conditions:

- During a Federal Reserve announcement

- Days before major economic data releases

- Periods of extreme market uncertainty, such as the market environments on April 9 or August 4, 2025

The Consolidation Trade Setup

Schwartz emphasized that the iron condor strategy has worked best after volatility has already occurred:

" That's when you might want to consider [iron condors]. It's the exact opposite [of what people think]. When things are narrowing down, you have the potential for volatility. That's not what you want."

Advanced Risk Management Techniques

"Set-and-Forget" versus Active Management Debate

Unlike other panelists who favored active management, Schwartz presented two distinct approaches:

Approach 1: Pure Set-and-Forget

- Place the trade with appropriate position sizing

- Accept the defined risk

- Let it expire naturally

- Applicable for traders who can't monitor positions constantly

Approach 2: The "10-Cent Bid" Strategy

Henry's sophisticated exit technique:

- Leave a standing 10-cent bid on the short strikes

- This often gets filled near the close as options decay

- Creates positive risk: If filled, the remaining risk becomes negative (profit)

- Provides protection against unusual end-of-day moves

Position Sizing Philosophy

Schwartz favors a set-and-forget-approach, rather than using stops and trying to actively manage the position. This reflects his institutional background where position sizing is used to manage risk rather than complex exit strategies.

Technical Execution Details

SPX-Specific Trading Considerations

Pricing Increments: SPX options trade in nickels ($0.05 increments) due to the high index value

- Execution Impact: Orders must be placed in 5-cent increments

- Liquidity Advantage: Extremely liquid market with tight spreads

- Complex Order Book: Spread trades may execute via Cboe’s Complex Order Book where market participants compete to provide structure-based liquidity.

Cash Settlement Benefits:

- No Assignment Risk: SPX is European-style and cash-settled

- No Pin Risk: Cash settlement eliminates pin risk and need to worry about finishing between strike prices.

- Clean Expiration: Positions automatically settle at 4:15 PM ET

The Minute-by-Minute Theta Decay

Schwartz highlighted how the new simulated returns tool, known as the LiveVol Trade Optimizer adapts for 0DTE trading:

"When we get into the zero-day expiry, our time slider in the bottom left... changes from going from one day at a time to minute by minute."

This allows traders to see exactly how time decay accelerates throughout the trading day, with theta becoming extreme in the final hours.

Results

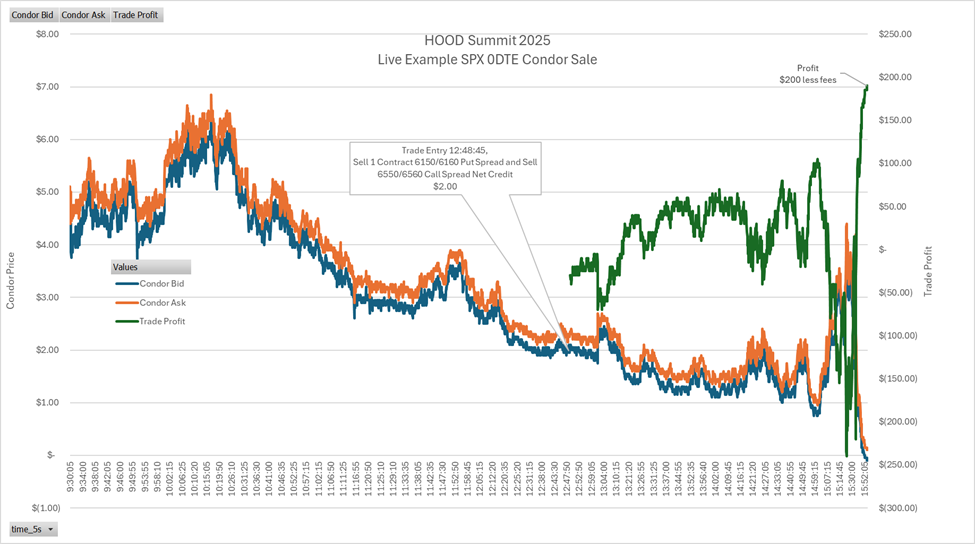

In order to illustrate the full trading process, the moderator executed a single-lot condor sale for $2 in premium near 12:49 ET, which ultimately expired with all options out of the money, resulting in net profit of $200 (the premium collected) less fees.

Source: Cboe Data

Market Structure Insights

Why 0DTE Has Gained Popularity

Schwartz’s institutional perspective on the phenomenon:

1. Retail Accessibility: Platforms like Robinhood have democratized access to sophisticated strategies

2. Defined Risk Appeal: Maximum loss is known upfront

3. Quick Resolution: Trades resolve within hours, not weeks or months

4. High Probability Strategies: When structured properly, offer attractive win rates

The Institutional vs. Retail Dynamic

Schwartz noted that while retail trades make up 50% of 0DTE volume, the strategies being used are increasingly sophisticated, suggesting retail traders are becoming more educated about options mechanics.

Advanced Considerations and Warnings

The Gamma Risk Reality

In his session, Schwartz noted the gamma risk that comes with 0DTE trading, explaining that gamma increases exponentially at expiration.

"You could be up you know 150 bucks five minutes before the close and you get one small move in the underlying and all of a sudden, you're down 400 or 500 bucks."

This underscores why the "set and forget" approach with proper sizing may be more appealing than trying to actively manage these positions.

Practical Implementation Guide

Schwartz's Step-by-Step Process

1. Market Assessment: Wait for morning volatility to settle

2. Strike Selection: Find 10-point spreads yielding approximately $1.00 each side

3. Risk Calculation: Ensure total risk (spread width minus credit) is acceptable

4. Execution: Use limit orders at or near the natural price

5. Management: Either set-and-forget or use the 10-cent bid strategy

Watch Schwartz's full session here.

Key Takeaways from Schwartz's Approach

Institutional Wisdom for Retail Traders

1. Respect the probabilities but understand they're not guarantees

2. Use market structure (cash settlement, liquidity) to your advantage

3. Don't fight the tape — wait for the appropriate market conditions

4. Size appropriately rather than relying on complex exit strategies

The Evolution of Retail Options Trading

The data shows that retail traders are becoming increasingly sophisticated, using strategies that were once the domain of professional traders. However, Schwartz emphasizes that this sophistication must be paired with proper risk management and realistic expectations.

The 0DTE iron condor strategy represents the convergence of institutional-level strategy with retail accessibility. Success requires understanding both the opportunities and the very real risks involved in same-day expiration trading.

*As of 9/8/25, Cboe data

The information provided is for general education and information purposes only. No statement provided should be construed as a recommendation to buy or sell a security, future, option on a future, security future, digital asset, financial instrument, investment fund, or other investment product (collectively, a “financial product”), or to provide investment advice.

In particular, the inclusion of a security or other instrument within an index is not a recommendation to buy, sell, or hold that security or any other instrument, nor should it be considered investment advice.

Cboe and/or any Cboe Company does not undertake to provide you with trading advice or any advice, recommendation, or representation regarding the suitability, profitability or appropriateness for you of any investment, financial product, investment strategy, third-party product or service, or expertise regarding trading in a financial product. You should undertake your own due diligence regarding your financial product and/or investment practices.

Past performance of an index or financial product is not indicative of future results.

No data, values, or other content contained in this document (including without limitation, index values or information, ratings, credit-related analyses and data, research, valuations, strategies, methodologies, and models) or any part thereof may be modified, reverse-engineered, reproduced, or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of Cboe.

Hypothetical scenarios are provided for illustrative purposes only. The actual performance of financial products can differ significantly from the performance of a hypothetical scenario due to execution timing, market disruptions, lack of liquidity, brokerage expenses, transaction costs, tax consequences, and other considerations that may not be applicable to the hypothetical scenario.

Brokerage firms may require customers to post higher margins than any minimum margins specified.

There are important risks associated with transacting in any of the Cboe Company products discussed here. Before engaging in any transactions in those products, it is important for market participants to carefully review the disclosures and disclaimers contained at: https://www.cboe.com/us_disclaimers/. These products are complex and are suitable only for sophisticated market participants. In certain jurisdictions, Cboe Company products are only permitted for investment professionals, certified sophisticated investors, or high net worth corporations and associations. These products involve the risk of loss, which can be substantial and, depending on the type of product, can exceed the amount of money deposited in establishing the position. Market participants should put at risk only funds that they can afford to lose without affecting their lifestyle. © 2025 Cboe Exchange, Inc. All Rights Reserved.