Macro Volatility Digest

Trending

Single Stock Volatility Jumps Higher as Earnings Approach

Implied volatilities were mixed across asset classes last week as risk of looming government shutdown weighed on sentiment despite better-than-expected economic data. Gold skew inverted further as demand for upside calls picked up, with 1M skew (25-delta ratio) falling to near a 1-year low. As focus shifts to this week’s NFP number, what stands out is how little is priced into the event, with SPX® weekly options implying just 0.9% move for Friday (vs. average realized move of 1.6% this year for NFP).

Read MoreLink to Report: Macro Volatility Digest

WHAT STANDS OUT:

- Implied volatilities were mixed across asset classes last week as risk of looming government shutdown weighed on sentiment despite better-than-expected economic data. Gold skew inverted further as demand for upside calls picked up, with 1M skew (25-delta ratio) falling to near a 1-year low. As focus shifts to this week’s NFP number, what stands out is how little is priced into the event, with SPX® weekly options implying just 0.9% move for Friday (vs. average realized move of 1.6% this year for NFP).

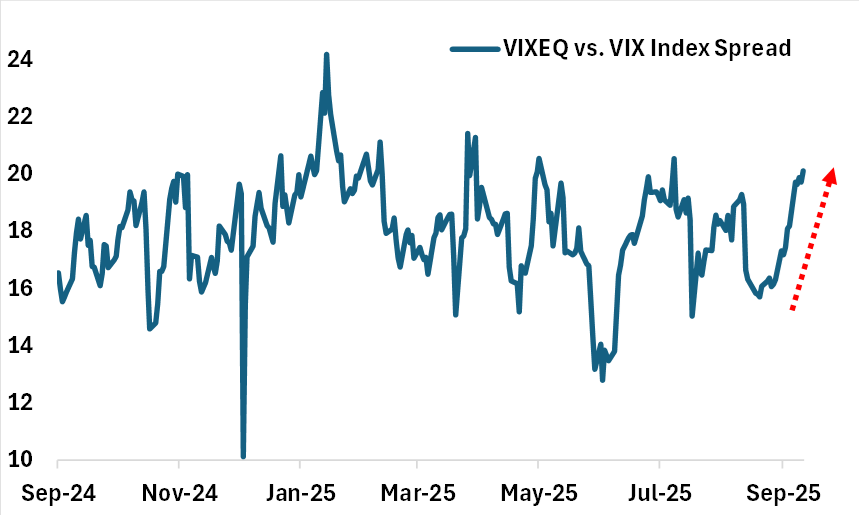

- As we approach earnings, single stock vols have picked up notably relative to the index. For example, the VIXEQSM index (weighted average single stock vol) is up ~4.5 vol pts in the last two weeks versus VIX® index up 0.5 pt. The spread between the two is now near a YTD high of 20 pts (see below). The bid to single stock vol is largely driven by the mega-caps (TLSA, AMZN, and META being the 3 largest contributors).

- Demand for protection picked up last week, driven by year-end hedging, with 3M skew rising the most versus other tenors. SPX 3M skew steepened from the 40th percentile low to the 70th percentile high (versus other tenors where skew is still trading ~50th percentile).

Chart: Single Stock vs. SPX Index Volatility Spread Widens to Near YTD High

Source: Cboe