“Meme Stock”-Induced Euphoria? Not Quite

Link to Report: Macro Volatility Digest

WHAT STANDS OUT:

- Meme stocks took center stage last week as retail investors piled into these speculative names, often using options for leverage. OPEN is one notable example. Over 3.4M contracts traded in OPEN last Monday, more than GOOGL, AMZN, AAPL, MSFT, and META combined. In fact, OPEN was the most active name in terms of options activity last Monday, accounting for 10% of all single stock option volume that day.

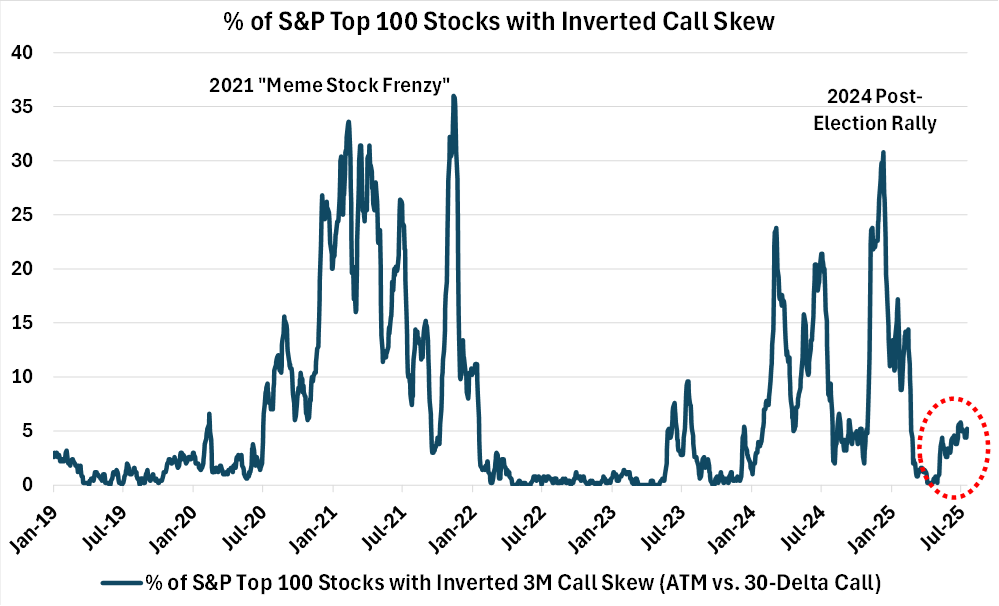

- Is this a sign of frothiness in the market? Not quite. While the options activity in these meme stocks is certainly speculative, we’re not seeing broader spillovers into other names yet. This is very different from the 2021 meme craze, when the speculative call buying extended to large swathe of the market. For example, over 30% of S&P top 100 names traded with inverted 3M call skew in 2021 (i.e. a sign of extreme bullish sentiment), currently it’s only about 5% (see chart below). In other words, right now the meme craze is still an idiosyncratic phenomenon, not a sign of broader market euphoria.

Chart: No Spillover From the Meme Craze This Time

[Download Full Report Here]

[Subscribe Here]