Volatilities Normalize Across Asset Classes Ahead of CPI

Link to Report: Macro Volatility Digest

WHAT STANDS OUT:

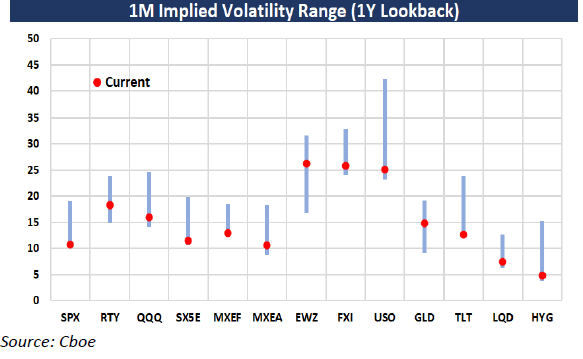

- Implied volatilities declined once again last week on the back of falling bond yields. Equity, credit, and rates volatilities have all normalized back to near 1-year lows ahead of this week’s CPI release as inflation fears subside. Within equities, the decline in volatility can be seen across global indices. Not only is SPX® 1M implied vol trading near a 1-year low, volatility across both developed and emerging markets are all near similar lows with the VXMXEA Index (MSCI® EAFE Volatility Index) and the VXMXEF Index (MSCI Emerging Market Volatility Index) all falling to the 5th percentile low as well.

- As highlighted last week, SPX vol-of-vol has declined meaningfully, with the VVIX index falling to a 9-year low of 73% on Friday. Surprisingly, VIX® call demand has remained fairly tepid on this latest leg lower in the VIX and VVIX in contrast with previous episodes over the past year when investors would step in to opportunistically add cheap tail hedges when volatility levels fell. The calm is especially notable ahead of this week’s CPI print.

Chart: Global Equity Index Vols Near 1-Year Lows Ahead of CPI

[Download Full Report Here]

[Subscribe Here]