The Week That Was: March 1 to March 5

Kevin Davitt

▬

March 8, 2021

A concise weekly overview of the U.S. equities and derivatives markets

Bond yields continued to be the market focus last week (March 1 to March 5), as Federal Reserve Chair Jerome Powell dd not assuage concerns about the recent move in longer-dated rates. As a result, market participants’ focus has shifted from reopening businesses and another potential stimulus package to whether interest rates will halt the continued rise in equity markets. However, it is possible for rates and the market to move higher in tandem. In the meantime, U.S. rates remain exceptionally low from a longer-term perspective. The February unemployment data was strong, showing an increase of 379,000 jobs for the month, primarily in leisure and hospitality industries. Overall, the labor market is still 9.5 million jobs below pre-pandemic levels.

Quick Bites

Indices

- U.S. Equity Indices were on a roller coaster last week with significant intraday volatility.

- S&P 500 Index (SPX): added eight tenths of one percent for the week.

- Nasdaq 100 Index (NDX): Fell for the third consecutive week, declining 1.9% week-over-week.

- Russell 2000 Index (RUT℠): Fell 0.6% compared to the previous Friday. On a closing basis, the RUT held its 50-day simple moving average (SMA).

- Cboe Volatility Index™ (VIX™ Index): Moved in a significant range last week, reaching intraday low of 22.45 on Wednesday before a high of 31.90 on Thursday afternoon.

Options

- SPX options volume averaged about 1.27 million contracts, in line with the previous week. Friday’s volume was 1.7 million contracts, which was similar to other recent event days – February 26 and January 29.

- VIX options average daily volume (ADV) was about 516,000 contracts, down from the previous week’s ADV of approximately 595,000 contracts. VIX options were particularly active during the Thursday session, with its call/put ratio nearly even for the week.

- RUT options volume increased week-over-week to an ADV of 39,000 contracts. Mini-Russell 2000 Index options launched on March 1 and traded about 2,300 contracts Tuesday.

Across the Pond

Global markets were mostly unchanged on a week-over-week basis.

- The Euro STOXX 50 Index was up slightly.

- The MSCI EAFE Index (MXEA™) and the MSCI Emerging Markets Index (MXEF™) were both marginally lower.

Charting It Out

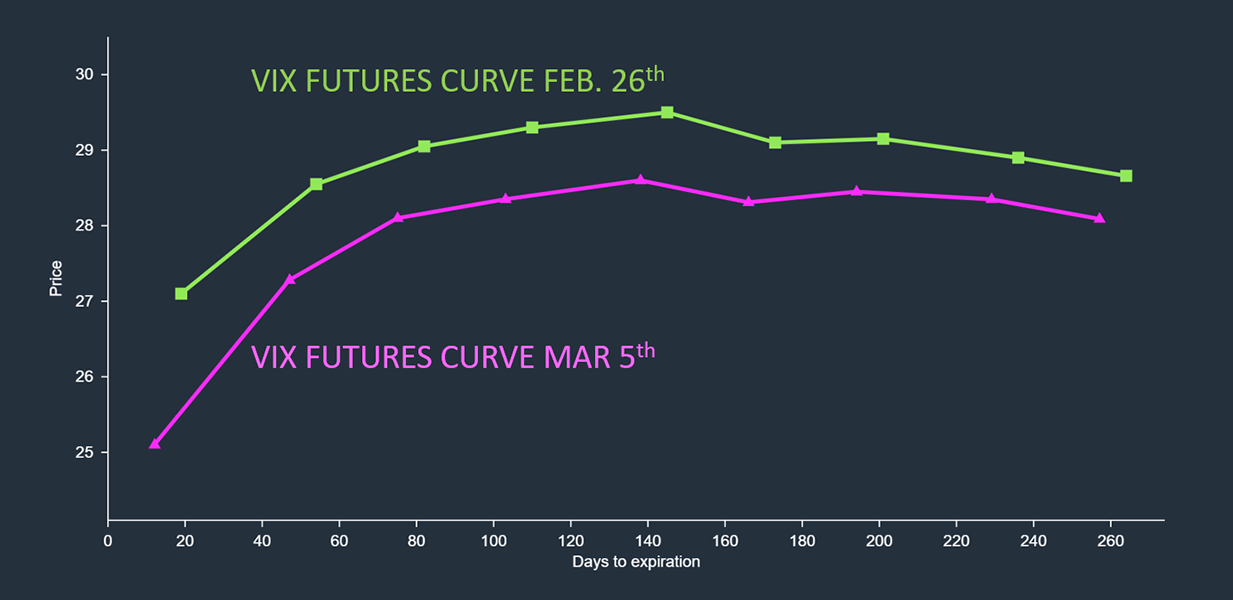

Observations on VIX futures term structure and the Russell Volatility Index

- The VIX futures curve maintained its shape, but futures came in across maturities as the front of the curve steepened. The March/April spread moved from 1.45 to 2.20 on a weekly basis.

- The March contract traded as high as 29.50 and as low as 22.70, settling at 25.10. Standard March VIX futures and options will expire on March 17.

VIX Futures Term Structure

Source: LiveVol Pro

- The Russell Volatility Index (RVX) ranged between 32.60 and 40.35 last week, marking the first RVX measure over 40 since the end of January, which came amidst the “short squeeze” selloff.

Russell Volatility Index December 2020 - Present

Source: LiveVol Pro

Macro Movers

- Big Tech: Google’s outperformance continues as the tech giant moves back near highs. The company announced it is eliminating third party cookies and replacing it with a “Federated Learning of Cohorts.”

- Microsoft and Apple were essentially unchanged week-over-week. Facebook traded higher and Amazon fell to $3,000 per share, its lowest weekly close since September 18, 2020.

- Tesla declined further and closed below $600 per share – Tesla’s lowest weekly close since November 27, 2020.

Coronavirus

- Over the past week there were about 63,000 new COVID-19 cases per day. That is a 10% decline from the 70,000 cases per day average seen in the previous week.

- COVID-19-related hospitalizations have declined for seven consecutive weeks.

- 17% of Americans have received at least one dose of a COVIDI-19 vaccine and 8.6% are considered fully vaccinated.

- Daily vaccination rates in the U.S. reached approximately 2 million in early March.

Current U.S. COVID-19 Cases

Source: The New York Times

Tidbits from the News

- The Organization of Petroleum Exporting Countries (OPEC) surprised the market last week by not increasing production. Brent and WTI crude oil moved up to October 2018 levels. Petroleum prices impact nearly every corner of the global economy.

Petroleum Prices

Source: Yahoo! Finance

- According to a recent report from The New York Times, it is estimated that there will be about 300,000 fewer births in the U.S. this year as a result of the COVID-19 pandemic. There’s a strong correlation between birthrates and the domestic economy, so this decline will likely lead to economic repercussions down the road.

The Week Ahead

- Data to be released: NFIB Small Business Index on Tuesday. Consumer Price Index (CPI) and Federal Budget on Wednesday, Weekly Jobless Claims on Thursday and the Producer Price Index (PPI) and preliminary University of Michigan Confidence Index on Friday.

Like what you see? Don’t miss the latest insights, webinars, news and announcements from the Cboe Options Institute.

The information in this article is provided for general education and information purposes only. No statements within this article should be construed as a recommendation to buy or sell a security or futures contract or to provide investment advice. Supporting documentation for any claims, comparisons, statistics or other technical data in this article is available by contacting Cboe Global Markets at www.cboe.com/Contact. Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of “Characteristics and Risks of Standardized Options.” Copies are available from your broker or from The Options Clearing Corporation at 125 South Franklin Street, Suite 1200, Chicago, IL 60606 or at www.theocc.com. Cboe Volatility Index and VIX are registered trademarks and of Cboe Exchange, Inc. All other trademarks and service marks are property of their respective owners. © 2021 Cboe Exchange, Inc. All Rights Reserved.