The Post-Election Volatility Surface Realignment

Ed Tom

▬

November 11, 2024

Link to Report: Macro Volatility Digest

WHAT STANDS OUT:

- Cross-asset volatilities which had had been elevated at 90+ percentile highs for the last month were crushed as the resolution of the US Presidential Elections and continued FOMC rate moderation catalyzed a cross-asset risk-on sentiment and normalized the implied volatilities of the major asset classes towards their historical average levels.

- The conclusion of the US elections tempered implied volatilities across the developed and emerging markets including, China, the target of Trump’s tariff ire. (Implied vols on FXI have fallen 6 vol pts post-Elections to 31 despite the China ETF’s -3.5% price pullback over the same time period.) In the US, the 7 pt VIX® Index fall (to 15) represented the largest one-week VIX decline since the US reopened its borders in Dec 2021 after a nearly 2-year Covid lockdown. Interestingly, the VIX move over the course of the week (SPX® +4.65%, VIX +7pts) was remarkably well anticipated by the unusually steep skew gradient established prior to the elections. 1M S&P skew has now flattened from its 98th %ile highs to 60th %ile. Vol-of-vol has likewise compressed from its 96th %ile highs with the VVIX Index falling 34 pts to 87 (57th %ile).

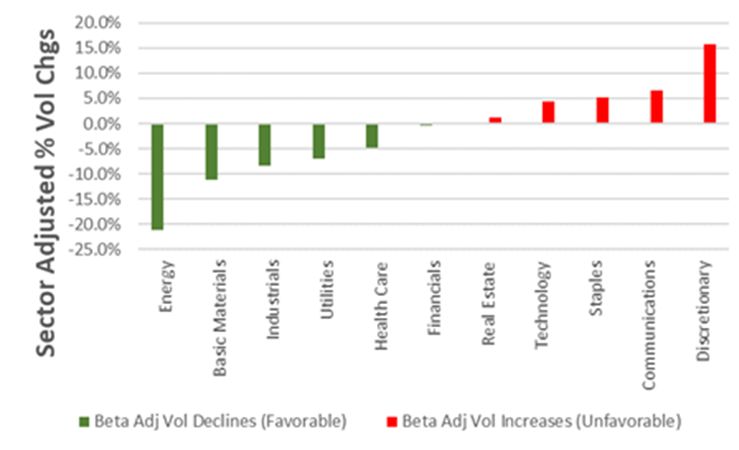

- Exhibit 3 assesses the Trump Trade at a sector level from the perspective of the volatility markets. This analysis shows the Post-Election market beta adjusted volatility premium/ discount currently priced into short term options. (i.e., a decline shows that the market neutral volatility reaction to the Elections was better than expected after accounting for market beta and vice-versa.) Accordingly, post-Elections sector trading suggests volatility traders anticipate a Trump administrative will herald a favorable outlook for the Energy, Materials & Industrials sectors and a relatively less favorable outlook for Communications & Discretionary stocks.

Chart: Volatility Traders Anticipate a Trump Administration Will Hearld a Constructive Outlook for Energy & Materials

Source: Cboe, Bloomberg

[Download Full Report Here]

[Subscribe Here]