Equity Rotation Gains Steam Ahead of Fed & Tech Earnings

Link to Report: Macro Volatility Digest

WHAT STANDS OUT:

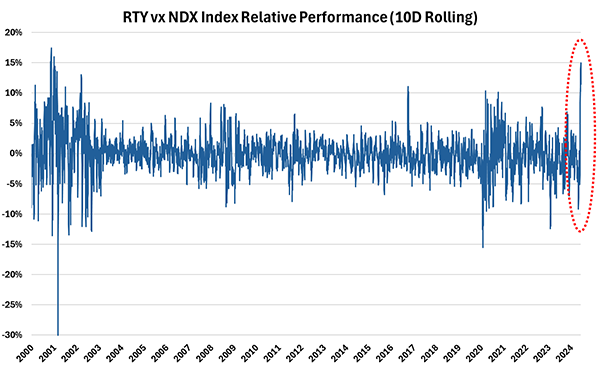

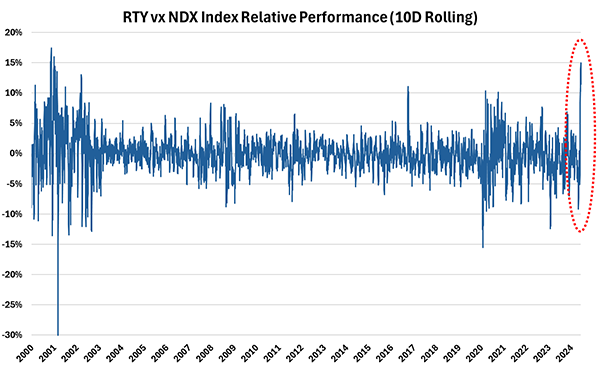

- While the VIX® index ended the week relatively unch’d, both NDX and RTY index implied vols increased meaningfully as the rotation trade gained steam, with small-caps outperforming large-cap Tech by the most since 2001 (bursting of the Tech Bubble). See chart below. RTY 1M implied vol currently screens as the richest across all global indices, up 1.3 pts to 23.2% (99th percentile high) while QQQ 1M implied vol increased 1.8 pts to 21.6% (96th percentile high).

- Skew diverged notably on last week’s sell-off, with SPX® and QQQ skew steepening while RTY skew flattened further on upside call demand. Term structure flattened across the board led by the front-end, with QQQ now joining RTY index as having an inverted term structure.

- ICYMI, Cboe is planning to launch new Cboe S&P 500 variance futures on September 23, 2024. To learn more, please see replay of our recent pre-launch webinar (featuring buy-side, sell-side, and market-making participants) as well as our variance futures resource hub for contract specs and FAQs.

Chart: Largest RTY vs. NDX Index Outperformance Since 2001

Source: Cboe

Source: Cboe

[Download Full Report Here]

[Subscribe Here]