Credit Volatility Falls to 10-Year Low Post CPI

Link to Report: Macro Volatility Digest

WHAT STANDS OUT:

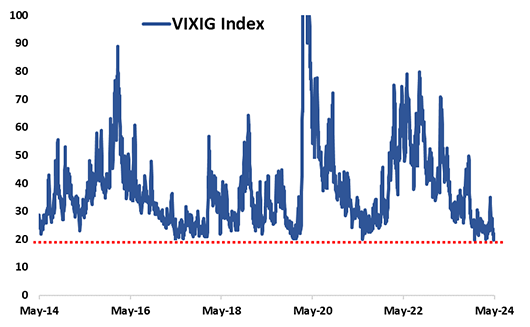

- Implied volatilities declined across asset classes last week as headline CPI inflation came in better-than-expected. While equity volatility fell to a 1-year low, credit volatility (VIXIG Index) collapsed to near a 10-year low as spreads tightened and inflation risk subsided. Against this backdrop of declining macro volatility (with every asset class vol trading below the 10th percentile), gold volatility continues to stand out as the richest cross-asset vol. GLD 1M implied vol gained another 1 vol pt last week to 15.8% as the precious metal broke out to new highs.

- With VIX® Index hitting a 1-year low, we’ve seen a notable pickup in demand for VIX upside calls over the past week as investors took advantage of the low VIX index level to add cheap tail hedges. This can be seen in the surge in VIX call volume, which jumped almost 50% wk/wk, as well as the increase in vol-of-vol, with the VVIX index rising by 5 vol pts to 78%.

Chart: IG Credit Volatility Falls to Decade Low Post CPI

Source: Cboe

[Download Full Report Here]

[Subscribe Here]