Cboe U.S. Equities Periodic Auctions

Cboe created its patented Periodic Auctions to establish an on-exchange alternative to the growth of off-exchange liquidity. Most recently, the use of conditional order types on Alternative Trading Systems (ATSs) has reached new highs as a percentage of ATS volumes. Periodic Auctions would offer a new price forming auction for investors seeking liquidity, including but not limited to block size transactions, during the course of the trading day. These intraday auctions may be a useful tool to attract buyers and sellers in less liquid or wider spread names, and would create an equal and fair market for market participants and investors that wish to either initiate or respond to such auctions. Periodic Auctions will be available on Cboe's BYX™ market center.

Periodic Auction Basics

- Will only be available on Cboe BYX during the Regular Trading Session (9:30 AM – 4:00 PM).

- Periodic Auction Order Types (e.g. Periodic Auction Only or Periodic Auction Eligible) will be non-displayed.

- Members may send Periodic Auction Only or Periodic Auction Eligible Orders.

| Periodic Auction Only |

|

|---|---|

| Periodic Auction Eligible |

|

- Continuous book Displayed and Non-Displayed orders (e.g. Midpoint Peg Orders) are not eligible to initiate a Periodic Auction but may be swept into the auction at the end of the auction process.

- A Periodic Auction will be initiated when a Buy Periodic Auction order is eligible to trade with a Sell Periodic Auction order within the auction collar price range.

-

Orders entered for securities trading below $500.00 (based on Last Sale) will not

initiate an auction for quantities below 100 shares.

- Periodic Auction Only orders will be rejected.

- Periodic Auction Eligible will be accepted but will be converted to a continuous book order.

-

The auction price will be collared by the more restrictive of the NBBO, LULD bands,

and a Midpoint-based collar.

- The Midpoint based collar will restrict the auction to trading at prices within a specified percentage above or below the midpoint of the NBBO.

- During Reg SHO restrictions, resting Periodic Auction Only Sell Short orders will be canceled and any new Periodic Auction Only Sell Short orders will be rejected while the restriction is in place. Similar to Continuous Book orders, Periodic Auction Eligible Sell Short orders will be repriced to avoid executing at an impermissible price.

-

Once a Periodic Auction is Initiated, a Periodic Auction message will be generated

and disseminated via the Proprietary Depth of Book Market Data Feed at a randomized

time prior to the end of the auction.

- Periodic Auction Message will include a reference price and matched size.

- No imbalance is included.

- Continuous book order quantity will not be included in the reference matched size or price.

- Once the initial randomized Auction message is disseminated, Auction Update messages will be sent every 5 milliseconds until the auction period has ended.

- All Periodic Auctions will run for a fixed time period of 100 milliseconds.

- Members may opt in to using a port setting to "Lock In" their orders and prevent cancellation of marketable orders during an auction.

- Periodic Auction Trade Messages will be sent as a single print for the price and size of all orders executed in the auction.

Execution Price and Priority

At the end of the auction period, the execution price for the Periodic Auction will be determined based on the following:

- Price where most shares will trade within the collar will be the auction price.

- If there are multiple prices where the same number of shares can trade, the price that leaves the smallest imbalance will be the auction price.

- If there are multiple prices where the same number of shares can trade and leave the smallest imbalance, the price closest to the volume-based tie breaker (i.e., generally the midpoint) will be the auction price.

Orders will be executed according to the following three priority levels:

- Displayed continuous book orders will be executed first using Price/Time Priority

- Periodic Auction orders will be executed second using Size/Time Priority

- Hidden continuous book orders will be executed third using standard BYX Priority

Technical Details

Members may send Periodic Auction Only and Periodic Auction Eligible orders using either FIX or BOE, utilizing the following instructions:

Periodic Auction Only

| FIX Tag | Req'd | Comments |

|---|---|---|

| 9355 (CrossTradeFlag) | Y | 1 = Periodic Auction Only |

| 110 (MinQty) | N |

Minimum total fill quantity, which may be made up of several consecutive smaller fills. If ‘Enable True MinQty’ port attribute is set to ‘Yes’, orders will be converted into standard MinQty during a Periodic Auction. Periodic Auction Eligible orders will remain as True MinQty in the continuous book. |

| 59 (TIF) | Y | R = Regular Hours Only |

| 18 (ExecInst) | N |

Only the following Peg instructions will be accepted:

R = Primary Peg M = Midpoint Peg |

| 211 (PegDifference) | N | Aggressive Offsets only for Primary Peg orders. |

| 9479 (DisplayIndicator) | Y | I = Invisible |

Periodic Auction Eligible

| FIX Tag | Required | Comments |

|---|---|---|

| 9355 (CrossTradeFlag) | Y | 2 = Periodic Auction Eligible |

| 110 (MinQty) | N |

Minimum total fill quantity, which may be made up of several consecutive smaller fills. If ‘Enable True MinQty’ port attribute is set to ‘Yes’, orders will be converted into standard MinQty during a Periodic Auction. Periodic Auction Eligible orders will remain as True MinQty in the continuous book. |

| 59 (TIF) | Y | All TIFs supported except FOK and IOC but will only be executed in a Periodic Auction during Regular Trading hours. |

| 18 (ExecInst) | N | All pegged order instructions allowed, but "Midpoint Peg Do not Trade in a Locked Market" (18=m) will only apply in the continuous book. |

| 211 (PegDifference) | N | No restrictions. Orders with passive offsets will not participate in the auctions. |

| 9479 (DisplayIndicator) | Y | I = Invisible |

Examples

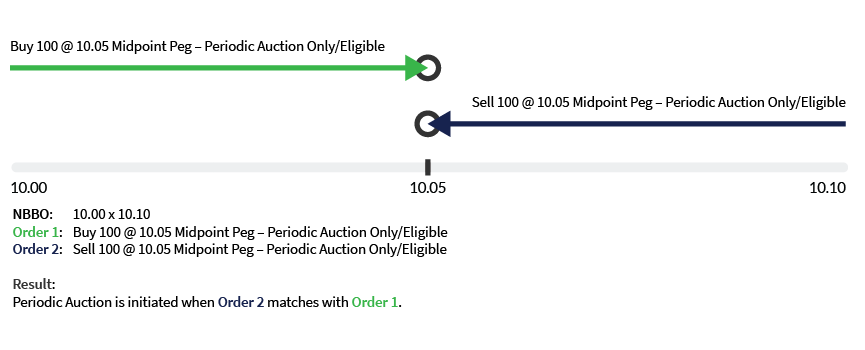

Example 1: Periodic Auction Only or Periodic Auction Eligible orders initiate an Auction

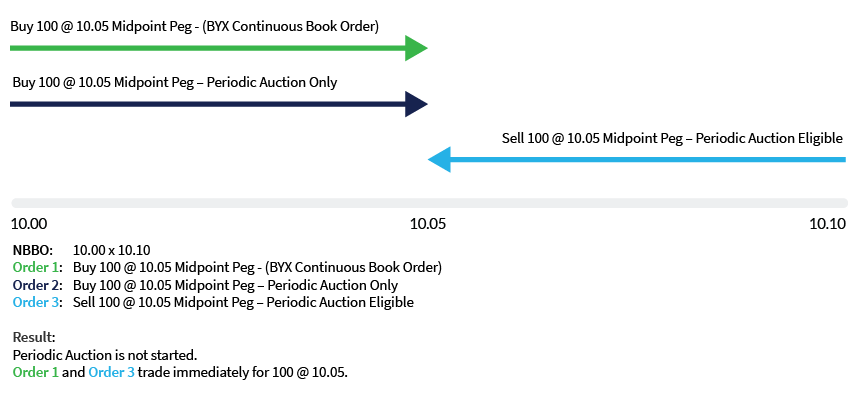

Example 2: Periodic Auction Eligible order can trade immediately with continuous book

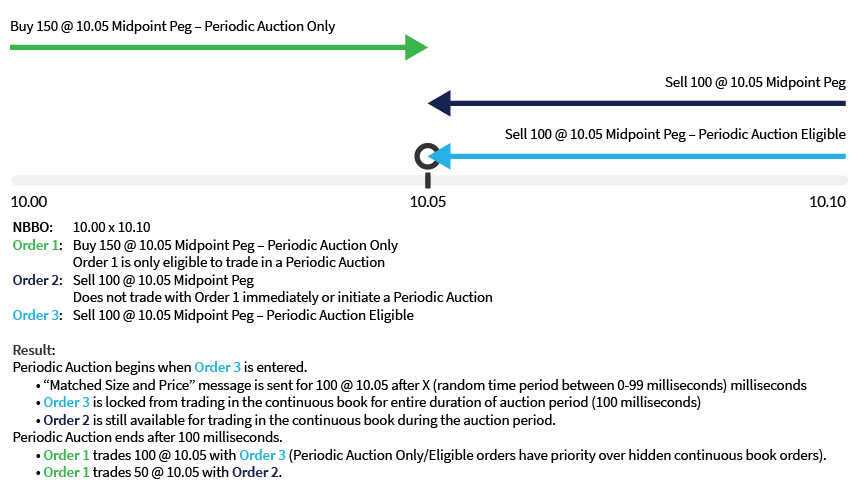

Example 3: Periodic Auction Only order and Periodic Auction Eligible order start an Auction

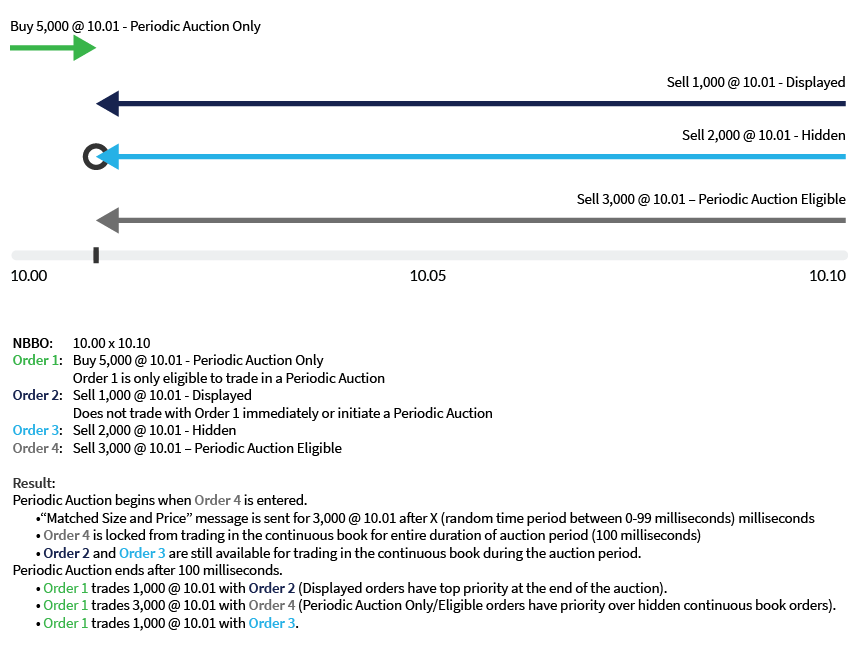

Example 4: Periodic Auction Price is at the NBBO offer

Contact

Please contact the Cboe U.S. Equities Trade Desk ([email protected], 913.815.7001) or your Director of Sales with any questions. We appreciate your continued support of Cboe and look forward to earning more of your business.