What Sets NEO-L Apart

In June 2022, Cboe officially completed its acquisition of NEO, the perfect complement to Cboe’s existing Canadian offerings, MATCHNow and Cboe BIDS Canada.

NEO is a next generation stock exchange focused on fairness, liquidity, transparency and efficiency offering a diverse set of products and services ranging from corporate listings, cash equities trading and a non-listed securities distribution platform.

NEO classifies two distinct types of traders operating in the markets today:

- Latency Sensitive Traders: those who trade for their own account using sophisticated technology and automated trading strategies

- NEO Traders: those who work on behalf of tong-term investors, buying or selling securities within the frame of investment strategy

NEO exchanges provide an innovative investor-focused model that gives queue priority benefits to retail and institutional long-term investors, or NEO Traders, with additional protections from a speed bump on liquidity removing orders. This technical speed bump is a randomized 3-9 millisecond delay, applied only to orders from high-frequency traders actively looking to take liquidity out of the market.

In Cboe’s North American Equities Execution Consulting Team’s latest analysis the team studied the composition of the Canadian equities market and took a deeper dive into NEO-L, one of NEO’s three diverse exchanges recently added to the Cboe global exchange network. The analysis highlights NEO-L’s unique trader priority mechanism for retail and institutional investors and examines the execution quality and performance benefits for individual investors by reducing the time to execution.

Canadian Market Composition

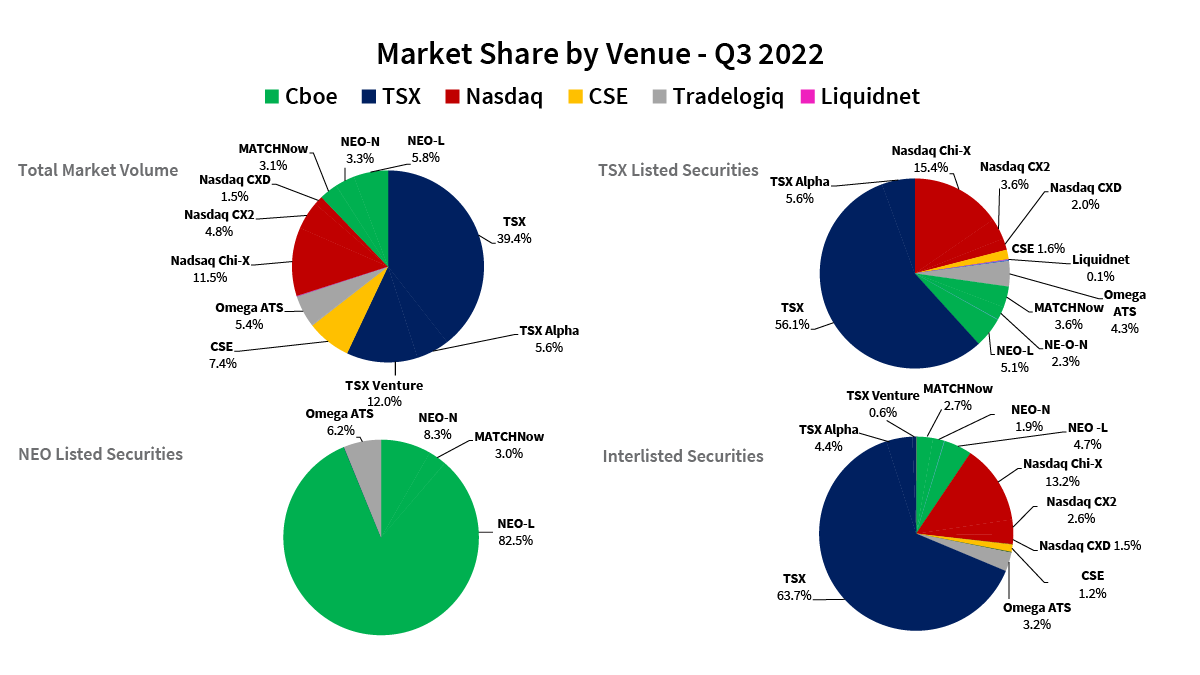

Market Share by Venue

With NEO joining the global Cboe exchange network, Cboe now represents a meaningful portion of trading volume in Canada, becoming the third largest exchange group in the region. Cboe’s total Canadian market share, including NEO and MATCHNow, was 12.2% in the third quarter of 2022. NEO-L was the largest of the four exchanges, with 5.8% market share, followed by NEO-N at 3.3%, MATCHNow at 3.1%, and NEO-D at 0.1%. In TSX-listed securities, Cboe has a market share of 11.1%, while TSX venues have a combined market share of 61.7% in these securities as of third-quarter 2022.

However, in NEO-listed securities, Cboe now has a 93.8% market share in these stocks. As the primary listing exchange, the majority of this volume is executed on NEO-L, with a market share of 82.5% in third-quarter 2022. Additionally, Cboe had a combined market share of 9.3% in interlisted securities during third-quarter 2022. NEO-L is the third largest venue for interlisted securities, behind only TSX and Nasdaq CXC, as illustrated below.

Figure 1 Source: Cboe

Figure 2 below shows the current composition of lit and dark exchanges in Canada. Cboe has a market share of 9.5% on lit exchanges, the third largest among exchange groups. However, Cboe also represents a considerable amount of market share in pure dark venues. Cboe’s 65.9% market share makes it the exchange group with the largest market share. MATCHNow is responsible for the bulk of that 65.9% market share at 64.5%.

Figure 2 Source: Cboe

Lit Size

Among lit exchanges in Canada, NEO-L ranks competitively with other major exchanges in average trade size in interlisted securities and ETF products. The figures below show average trade size by lit exchange in third-quarter 2022. NEO-L and NEO-N ranked fifth and sixth, respectively, in interlisted securities average trade size in third-quarter 2022. However, in ETF products, NEO-L ranked second in largest trade size, with an average size of 920.

Figure 3 Source: Cboe

Figure 4 Source: Cboe

The Importance of Time

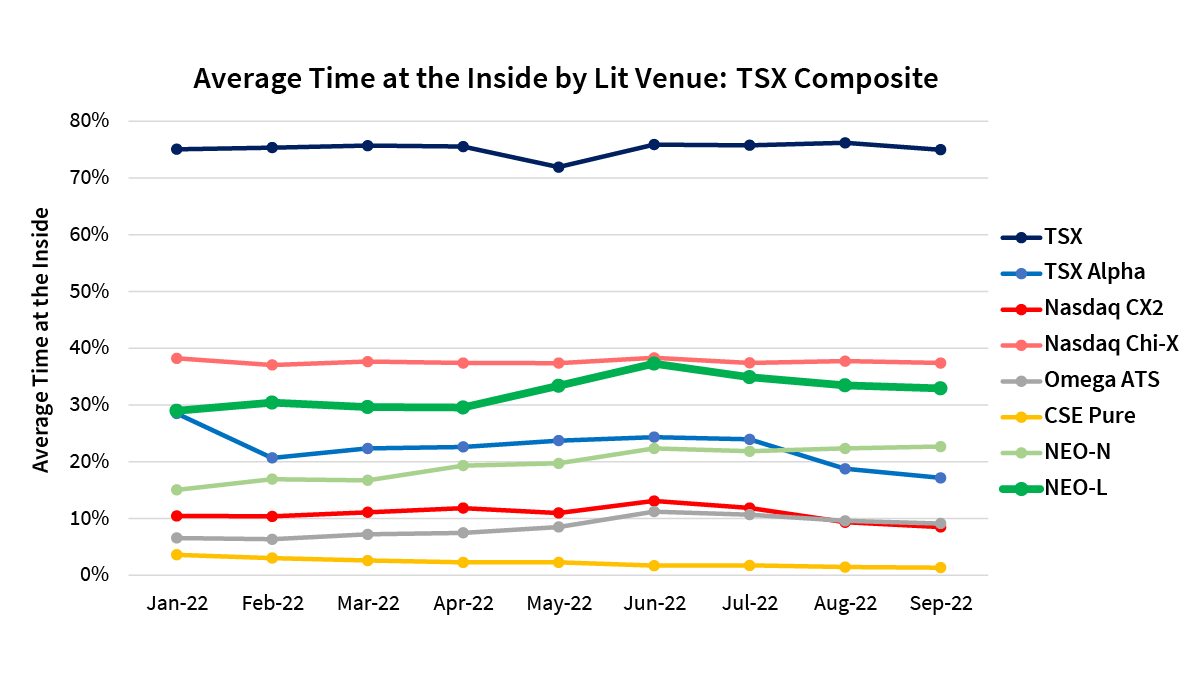

A crucial metric to consider when routing orders to certain exchanges is how often they are at the inside of the National Best Bid or Offer (NBBO). We studied the average time at the inside by lit exchange in the TSX Composite, interlisted securities and NEO-listed securities. NEO-L ranks fourth among lit exchanges with time at the inside in TSX Composite symbols. NEO-L’s time at the inside in these symbols increased from 29% in January 2022 to 37% in June 2022, before coming back down to 33% in September 2022.

NEO-L performs very competitively in time at the inside in interlisted securities compared to other lit exchanges, ranking third for interlisted securities with orders at the inside 40% of the time. As demonstrated in the figures below, NEO-L is at the inside a meaningful amount of time in some of the most actively traded symbols in the region.

Conversely, NEO-N, NEO’s inverted exchange ranks fourth in time at the inside in both the TSX Composite and interlisted securities. NEO-N’s time at the inside in TSX Composite symbols grew from 15% in January 2022 to over 23% in September 2022 and the exchange out-ranks all other inverted exchanges in time at the inside in these securities.

Figure 5 Source: NEO

Figure 6 Source: NEO

In NEO-listed securities, NEO-L dominates time at the inside as the largest exchange, compared to any other lit exchange. NEO-L is at the inside 70% of the time in NEO-listed securities, which directly relates to NEO-L’s 82.5% market share, the largest in these securities.

Figure 7 Source: Cboe

What Sets NEO-L Apart

Retail Trader Priority

NEO-L is a marketplace that encourages liquidity and levels the playing field for long-term investors by offering a unique priority mechanism for these traders. NEO-L gives resting orders from NEO Trader priority regardless of which orders hit the market first.

Figure 8 below breaks down the activity on NEO-L as a percentage of the exchange’s total volume by different order flow types. NEO Trader represents both institutional and retail traders at 67%, on average, and retail represents about 25% of NEO-L’s total volume. In August 2022, retail volume reached a high for the year at 30% of NEO-L’s book. This data highlights that a significant amount of activity benefits from the unique priority mechanism offered by NEO.

Figure 8 Source: NEO

Again, time at the inside of the NBBO, as well as time to first fill, are important metrics to consider when comparing the performance of retail and non-retail volume. Figure 9 below shows the average time at the inside of the NBBO in seconds for retail and non-retail volume on NEO-L. Retail volume is at the inside for 1,232 seconds, or 43% longer than non-retail volume, which is at the inside for 694 seconds. Retail volume’s time at the inside has grown over the course of the year, while non-retail volume’s time at the inside remained relatively unchanged.

Figure 10 shows the average time to first fill in seconds for retail and non-retail volume on NEO-L. Due to the priority mechanism on NEO-L, retail volume was filled in 313 seconds, compared to 491 seconds for non-retail volume, or 37% faster, in September 2022. On average for 2022, retail volume is executed 67% quicker than non-retail, demonstrating how NEO’s priority mechanism improves performance and execution quality to benefit trading strategies from both retail and institutional traders.

Figure 9 Source: NEO

Figure 10 Source: NEO

This data makes the value of NEO-L’s priority mechanism apparent, as it enhances both retail and institutional investors’ execution quality. Together, Cboe and NEO are delivering efficient, transparent trading to investors in Canada and will continue to bring new, innovative products to the market.

Please reach out to our coverage team with questions and to learn how we can help you optimize your trading experience.

The information in this presentation is provided for general education and information purposes only. No statement(s) within this presentation should be construed as a recommendation to buy or sell a security or to provide investment advice. The views expressed herein are those of the author and do not necessarily reflect the views of Cboe Global Markets, Inc., or any of its affiliates. Neo Exchange Inc. (“ Neo Exchange” or “Neo”) is a FinTech Company that provides capital raising and liquidity solutions. MATCHNow is a Canadian marketplace operated by TriAct Canada Marketplace LP. and is a Member of the Investment Industry Regulatory Organization of Canada (“IIROC”). Cboe BIDS Canada, MATCHNow and Neo are considered affiliates of Cboe Global Markets, Inc.