The Evolution of Retail Investment Activity

Equities trading activity among retail investors has grown significantly over the past few years, much of which can be attributed to the rise in popularity of online investment forums in early-2021. The successes of social media-driven “meme” stocks including GameStop Corp. (NYSE:GME) and AMC Entertainment Holdings, Inc. (NYSE:AMC) dominated global news headlines, pushing retail trading activity to all-time highs. Cboe’s Equities Execution Consulting team recently looked back at the 2020-2021 “meme” stock phenomenon in order to further analyze the development of the role that online communities played in influencing retail investment trading activity within U.S. equities markets.

The team analyzed a dataset of the top 15 daily most-mentioned stocks on Reddit, along with Cboe proprietary datasets, in order to explore the dynamic impact that online trading forums have had on overall market structure. Through the analysis of factors such as share price, Reddit mentions, Total Composite Volume (TCV), and Limit Up/Limit Down (LULD) halts, we ultimately found that while there was once a strong relationship between social media activity and retail market structure, the strength of that bond has since significantly diminished.

Changes in Retail Investment Activity

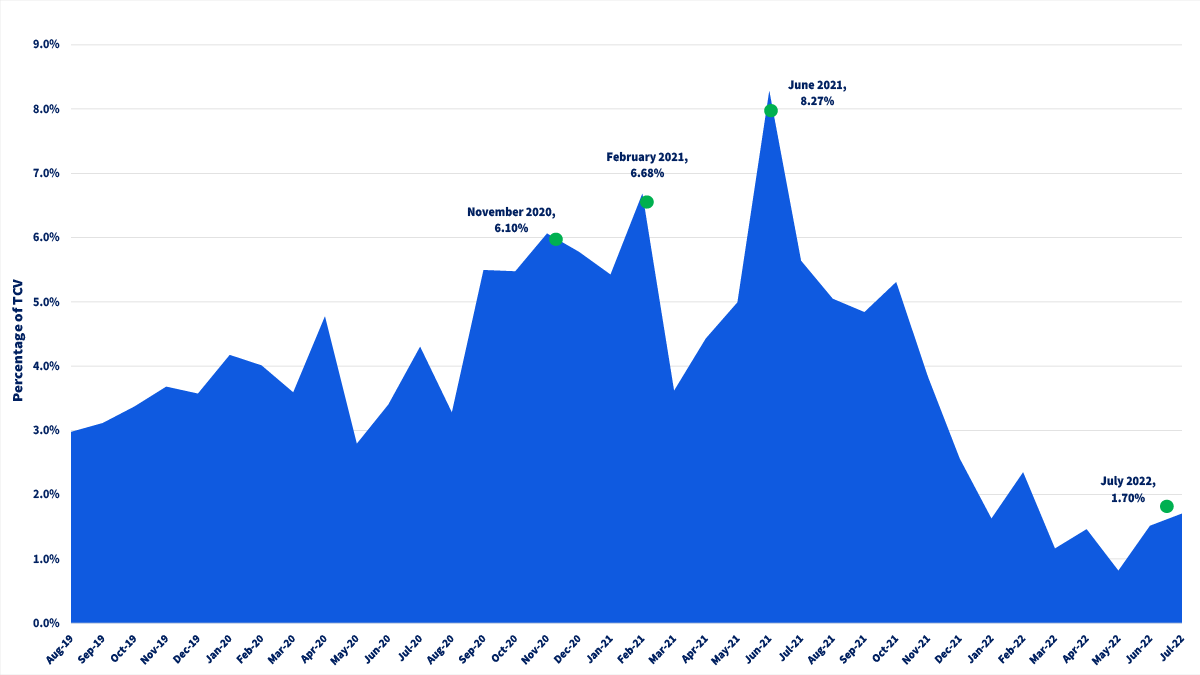

First, we consider TCV, a metric that measures total shares executed across all U.S. equities markets. Exhibit 1 below shows the monthly percentage of total trade volume in the top 15 “meme” stocks, relative to overall TCV. As expected, noteworthy peaks are concentrated almost exclusively between the end of 2020 and the beginning of 2021, approximately the same period of time when these “meme” stocks were most prevalent in the news. What is most interesting, though, is how this metric has evolved since, as the top 15 meme stocks shifted with popular sentiment. Just after June 2021, trading volume in “meme” stocks experienced a sharp decline, indicative of a waning interest in online retail trading movements. As of July 2022, popular “meme” stocks only accounted for approximately 1.7% of all monthly volume, falling significantly below even pre-COVID levels, when retail trading was much less publicized.

Exhibit 1

Monthly Trading Volume: Top 15 Meme Stocks Relative to TCV

Sources: Reddit and Cboe Global Markets

Despite the decline in trading activity for popular “meme” stocks, the interest in equities trading among retail investors has remained consistent, as evidenced by the Securities Exchange Commission (SEC) 606 data illustrated in Exhibit 2, below. The SEC’s Rule 606 requires all broker-dealers who route orders in equity and option securities to publish quarterly reports, which provide a general overview of their routing practices. These requirements are intended to create more transparency in evaluating order routing practices.

Exhibit 2

Total Addressable Markets: SEC 606 Retail Brokers

Source: S3 and Cboe Global Markets

While retail investment activity did peak in late-2020 and early-2021, the subsequent trends were different from the ones shown in Exhibit 1. Even with a major decline in the relevance of “meme” stock trading, retail average daily volume (ADV) grew more than 130% from January 2020 to March 2020, as shown above. It appears that while retail investors have remained active market participants, their interest in “meme” stock trading has declined sharply. Comparing the successes of some of the quintessential “meme” stocks with the shortcomings of others is compelling evidence as to what likely caused retail investors to shy away from “meme” stock trading more recently.

Successes and Failures on Reddit

GameStop Corp. (NYSE:GME)

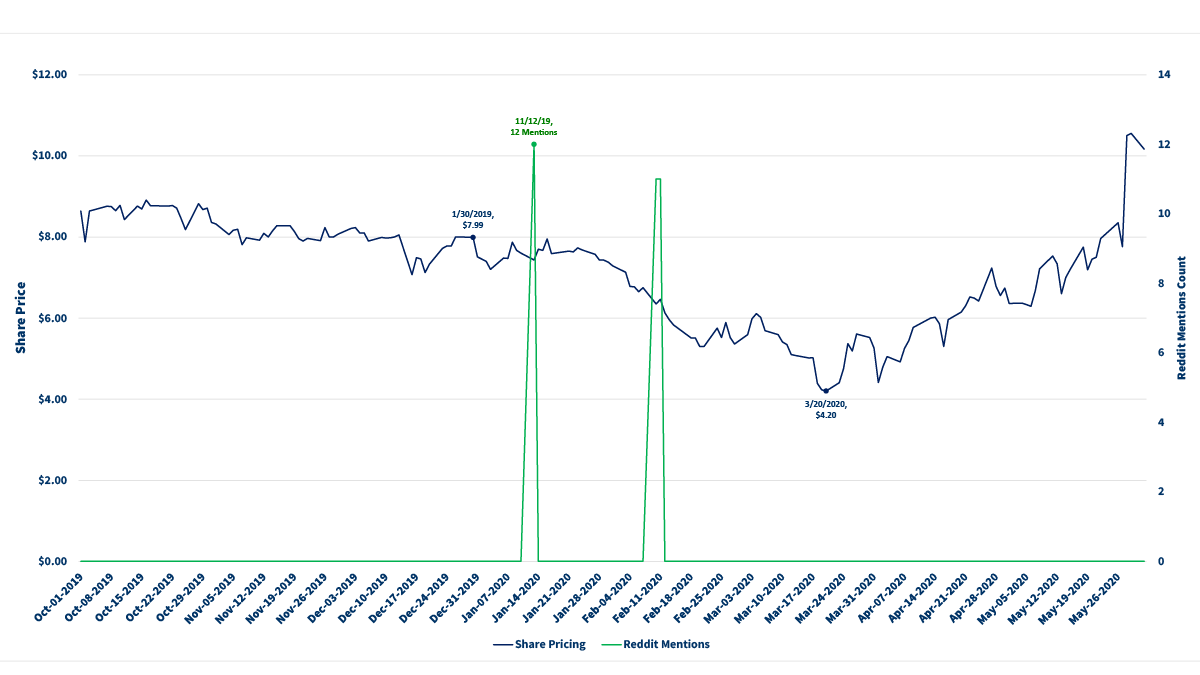

In 2021, institutional investors were pessimistic about the future of GameStop, a company that for decades thrived off of physical video game sales, which were now being dominated by downloadable content. Consistent with the negative outlooks regarding the future of GameStop, institutional investors established significant short positions in the company, so much so that short interest grew to exceed 100%[1] of shares outstanding for some time. Meanwhile, the retail investors congregating on social media platforms like Reddit seemingly had a more positive outlook on the future of GameStop, seeing strong potential for a “short squeeze”. A short squeeze generally involves a large, short-term spike in a stock’s share price that occurs when a significant number of short sellers are forced to buy shares and exit their positions all at once. With this trading strategy in mind, these retail investors publicized their positivity towards the company, and even coordinated purchases of the stock in some cases. As a result, share prices increased precipitously, leading to major success for early investors. Exhibit 3 below illustrates the relationship between Reddit mentions and share price, revealing an apparent causation in this successful case, where Reddit buzz fueled rapid price increases.

Exhibit 3

GameStop Corp. (NYSE: GME)

Source: CapitalQ

Activities in these social media communities ended up being the catalyst of extreme volatility in GME for an extended period, which can be seen through a significant uptick in Limit Up/Limit Down (LULD) halts.

Limit Up/Limit Down Plan Overview

LULD halts came as a direct result of the 2010 Flash Crash, when troubling news overseas concerning the European Debt Crisis led to a slew of panic and irrational decisions. In just 20 short minutes, 2 billion shares traded with a total value exceeding $56 billion, over 20,000 of which were executed at prices 60% or more away from their price at the beginning of the time window. The SEC observed a need to limit panic and extreme short-term volatility in order to eliminate irrational trades being executed. The later-implemented LULD plan was designed to prevent trades in National Market System (NMS) stocks from occurring outside of specified price bands, which are set at a percentage (determined based on several parameters outlined below) above and below the average reference price of a security over the preceding 5-minute period. If the National Best Bid or Offer (NBBO) escapes the pricing bounds defined by the LULD plan, a limit state will be entered, followed by a 5-minute trading halt if conditions do not improve. These halts continue until volatility calms.

Bands are doubled during last 25 minutes of the regular trading day for all Tier 1 Securities and all Tier 2 Securities below $3.00.

Source: Limit Up Limit Down (luldplan.com)

As shown in Exhibit 4, GameStop experienced several months of extreme volatility, a direct result of the Reddit buzz’s impact on the markets. In the case of GameStop, as noted previously, this Reddit-induced volatility was a positive for early entrants in the retail investment space. However, our research shows that this type of volatility is not always beneficial to retail investors.

Exhibit 4

GameStop Corp. (NYSE: GME) | Limit Up Limit Down (LULD) Halts vs. Reddit Mentions

Source: CapitalQ

Live Ventures, Inc. (NASDAQ:LIVE)

Even before the 2021 meme stock phenomenon, there are plenty of instances where it can be argued that retail investment behavior was a catalyst for volatility, especially in illiquid names. For example, as shown below, Live Ventures, Inc., spiked in relevance on Reddit, followed by a period of heightened volatility and uncertainty in its stock, with several LULD halts occurring over the next few months.

Exhibit 5

Live Ventures, Inc. (NASDAQ: LIVE) | Limit Up Limit Down (LULD) Halts vs. Reddit Mentions

Source: CapitalQ

Examples like Live Ventures demonstrate that using online communities as a forum for collective retail investment decisions is not always successful in increasing the price of a security. As shown in Exhibit 6, this venture by retail investors was not quite as lucrative as the efforts toward GameStop Corp. and AMC Entertainment Holdings, Inc., as the increased volatility eventually ushered in a decline in stock price.

Exhibit 6

Live Ventures, Inc. (NASDAQ: LIVE) | Share Price vs. Reddit Mentions

Sources: CapitalQ and Reddit

From our findings, it is evident that for every GME or AMC, there are many more failed Reddit movements. We believe the continued failure of this strategy caused the large decline in typical meme stock herd mentality investment practices that we previously analyzed. However, even with the popularity of “meme” stocks declining, the early-2021 movement was undoubtedly instrumental in growing the customer bases of all retail brokerages and is extremely important to the continued growth of retail markets.

Conclusion

Even as the popularity of “meme” stocks declines, retail brokers have experienced a sustained uptick in demand for their services. Through the implementation of several new products, Cboe has made changes meant to benefit retail customers on its platforms as this demand continues to grow. Cboe’s EDGX Retail Priority enhances execution quality and trading outcomes for individual investors by reducing the time to execution, a product that has continued to attract interest from retail trading participants as the retail market has grown. Cboe also offers a Retail Membership Program on EDGX, which provides members that meet the eligibility requirements with discounted fees for firm membership, logical and physical ports and market data access. This program gives investors the opportunity to participate in enhanced transaction pricing programs for retail orders. On BYX, Cboe offers its Retail Price Improvement Program, allowing any BYX Exchange Member to input Retail Price Improving (RPI) orders on the BYX Exchange order book that will offer price improvement in $0.001 increments to Retail Member Organizations that enter a Retail Order. Some of these products are analyzed in further detail in our recent blog, How Retail Priority Benefits End Investors, as well as on Cboe’s website.

Please reach out to our coverage team with questions and to learn how we can help you optimize your trading experience.